In the ever-evolving world of cryptocurrencies, the demand for efficient and reliable mining machines continues to surge. As more individuals and enterprises seek to capitalize on blockchain technology, understanding price points in the crypto mining machine market becomes crucial. Whether you’re diving into Bitcoin (BTC) mining or exploring newer coins like Ethereum (ETH) and Dogecoin (DOG), the machinery you invest in can make or break your profitability. Hosting options, mining rigs’ capabilities, and exchange volatility all interplay, creating a complex ecosystem worth exploring.

The mining rig—a powerful hardware suite designed to solve complex cryptographic puzzles—forms the backbone of successful crypto mining operations. These rigs vary widely in price based on their hash rate, energy efficiency, and manufacturer reputation. For instance, Bitcoin miners often gravitate toward ASIC (Application-Specific Integrated Circuit) machines that specialize in SHA-256 calculations, offering unparalleled speed but at a substantial upfront cost. Conversely, Ethereum mining thrives on GPU (Graphics Processing Unit) rigs, which provide the flexibility to mine various altcoins when Ethereum transitions fully to proof-of-stake.

Entering the market as a solo miner demands careful consideration of machine investment. While top-tier ASIC miners for BTC mining can range from several hundred to several thousand dollars, hosted mining services offer an attractive alternative. Through mining machine hosting, users lease hardware capacity situated in specialized data centers, benefiting from optimized cooling, consistent power sources, and uninterrupted internet connectivity. This model mitigates technical overhead and reduces entry barriers, providing enthusiasts a pathway into mining without the daunting setup.

Mining farms have emerged as hotspots where these massive clusters of mining rigs are maintained under professional oversight. These farms not only amplify hashing power but also leverage economies of scale to negotiate better electricity rates—a critical factor since energy consumption significantly impacts mining profitability. Bitcoin farms, in particular, are often situated in regions with abundant renewable energy to offset ecological concerns, boosting both operational efficiency and sustainability.

In contrast, the altcoin scene, with ETH and DOG coins, promotes diversity in mining equipment choice. Ethereum miners rely heavily on GPU rigs that can be adjusted and upgraded with relative ease, influencing the price points distinctly from ASICs. Dogecoin, initially considered a ‘meme coin,’ benefits from merged mining with Litecoin, harnessing combined resources and further complicating equipment selection.

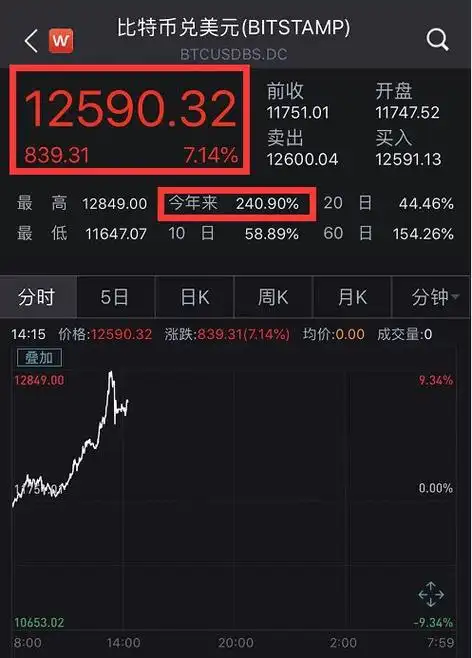

Another evergreen consideration is the state of cryptocurrency exchanges and market price fluctuations. Mining profitability is tightly linked to crypto coin values on major exchanges. As prices spike, demand for mining hardware increases, frequently leading to price inflation or supply shortages. Conversely, downturns can encourage discounting but also risk pushing miners to shut down rigs due to unsustainable operation costs. Strategic timing in purchasing mining machines or hosting contracts, therefore, becomes a game of market insight and predictive analytics.

For investors evaluating hosting versus purchasing, the debate often hinges on long-term cost versus control. Ownership guarantees direct asset possession, enabling miners to customize configurations and redeploy machines flexibly. Hosting, meanwhile, presents a hands-off approach with fixed monthly fees, no worries about hardware maintenance, and no local energy cost exposure. Both paths have benefits accelerated or decelerated by underlying market conditions in BTC, ETH, or DOG ecosystems.

Moreover, the mining industry’s environmental implications push innovation in machine design. Energy-efficient miners, leveraging leaps in silicon chip manufacturing and cooling technology, allow for reduced operational expenses and increased margins. Advances in artificial intelligence optimization also promise smarter, adaptive mining rigs that can switch between algorithms and coins based on real-time profitability, offering a glimpse of a compelling future for crypto mining machines.

In conclusion, navigating the crypto mining machine market reminds investors and enthusiasts alike that price points do more than dictate upfront cost; they reflect technological capabilities, market sentiment, and logistical considerations. The dynamic interplay among mining rigs, hosting options, farm operations, and exchange behaviors frames a rich tapestry where knowledge and agility convert hardware into wealth. In this vibrant ecosystem, understanding and mastering these variables is the path to mining success.

Leave a Reply